The Facts About Estate Planning Attorney Uncovered

The Facts About Estate Planning Attorney Uncovered

Blog Article

Examine This Report about Estate Planning Attorney

Table of ContentsThe Best Guide To Estate Planning AttorneyThe 9-Second Trick For Estate Planning AttorneyAn Unbiased View of Estate Planning AttorneyThe 25-Second Trick For Estate Planning Attorney

Estate planning is an action plan you can utilize to establish what happens to your possessions and commitments while you live and after you die. A will, on the other hand, is a lawful record that describes exactly how possessions are distributed, who looks after youngsters and family pets, and any type of other dreams after you pass away.:max_bytes(150000):strip_icc()/estate_planning_shutterstock_525382207-5bfc307846e0fb00517cd38d.jpg)

The administrator likewise needs to repay any type of taxes and financial obligation owed by the deceased from the estate. Creditors typically have a restricted amount of time from the date they were notified of the testator's death to make claims versus the estate for money owed to them. Insurance claims that are declined by the administrator can be brought to justice where a probate judge will have the final say regarding whether the insurance claim stands.

Estate Planning Attorney for Dummies

After the stock of the estate has been taken, the value of assets determined, and taxes and financial obligation repaid, the administrator will after that look for permission from the court to distribute whatever is left of the estate to the recipients. Any kind of estate taxes that are pending will come due within nine months of the date of death.

Each individual locations their properties in the count on and names someone apart from their spouse as the beneficiary. A-B depends on have actually come to be much less preferred as the inheritance tax exception functions well for many estates. Grandparents might transfer possessions to an entity, such as a 529 strategy, to support grandchildrens' education and learning.

Indicators on Estate Planning Attorney You Need To Know

Estate planners can deal with the contributor in order to decrease gross income as a result of those payments or formulate strategies that take full advantage of the impact of those donations. This is another approach that can be made use of to limit fatality tax obligations. It involves a specific securing in the current value, and therefore tax obligation, of their residential property, while attributing the worth of future growth of that capital to an additional individual. This method includes freezing the worth of a possession at its worth on the date of transfer. As necessary, the amount of possible resources gain at fatality is likewise frozen, allowing the estate planner to estimate their possible tax liability upon fatality and better plan for the repayment of income taxes.

If enough insurance proceeds are offered and the policies are properly structured, any kind of revenue tax on the considered personalities of properties adhering to the death of a person can be paid without considering the sale of properties. Profits from life insurance policy that are gotten by the recipients upon the death of the guaranteed are normally income tax-free.

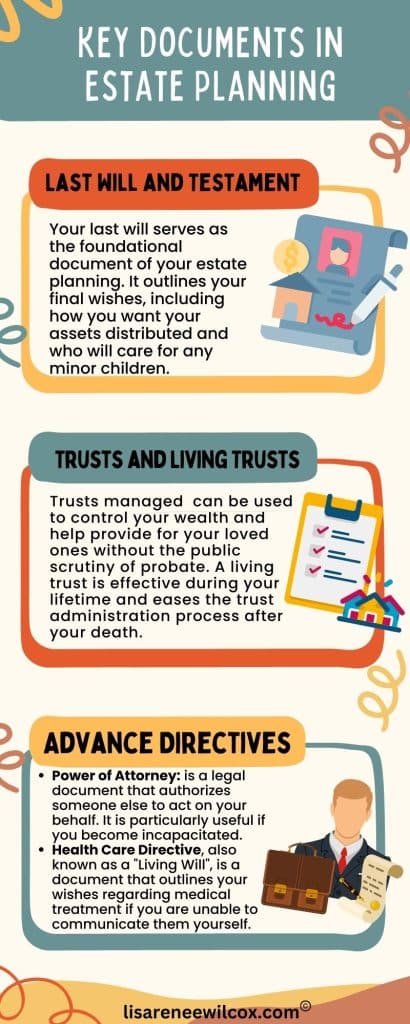

There are specific documents you'll require as part of the estate planning procedure. Some of the most common ones consist of wills, powers of attorney (POAs), guardianship classifications, and living wills.

There is a myth that estate planning is just for high-net-worth individuals. That's not real. In reality, estate preparation is a device that everyone can make use of. Estate intending makes it simpler for people to establish their dreams before and after they die. Unlike what most individuals think, it expands past what to do with possessions and obligations.

The Ultimate Guide To Estate Planning Attorney

You need to begin preparing for your estate as quickly as you have any type of measurable property base. It's an ongoing procedure: as life proceeds, your estate plan must change to match your situations, in line with your new goals.

Estate preparation is frequently taken a tool for the wealthy. That isn't the case. It can be a beneficial means for you to handle your visit the site possessions and responsibilities prior to and after you pass away. Estate preparation is additionally a fantastic method for you to lay out prepare for the care of your minor kids and pet dogs and to outline your yearn for your funeral service and favorite charities.

Applications need to be. Eligible candidates who pass the examination will be officially licensed in August. If you're qualified to sit for the examination from a previous application, you might submit the brief application. According to the rules, no qualification shall last for a period much longer than try here 5 years. Find out when your recertification application schedules.

Report this page